All businesses must keep track of their costs of conducting business, which includes managing spending. To be reimbursed for out-of-pocket expenses, employees must submit expense reports. Managers must approve these charges for reimbursement, track how much the company spends on T&E (travel and expense), and document everything for tax purposes to guarantee that the company may claim all applicable deductions.

By streamlining the process in five areas, automated expenditure reporting software helps firms streamline T&E operations, increase efficiency, and raise the bottom line.

Employees can upload expense reporting and supporting documents, such as images or scans of receipts, directly into the software from their laptops, tablets, or cellphones, obviating the need to fill out paper forms or keep track of sales slips. Reimbursement is hastened, putting money back in the hands of employees and removing the frustration that comes with delays.

Additionally, as new and improved collaboration tools improve the experience of remote teams, the number of people working from home is projected to rise for organizations that offer the option.

As a result, businesses want a simple method for employees to submit expenses and receive reimbursed at any time, whether at home or on the road.

The advantages also apply to finance departments

Efforts to increase efficiency while lowering expenses are currently a top expenditure management trend. Here are four ways that software can assist:

According to research by the Association of Certified Fraud Examiners, expense reports were found to be the source of 11 per cent of fraud cases in organizations with more than 100 employees. False claims or duplicate entries divert funds from the company to the pockets of dishonest employees.

Expense management software is essential for complying with IRS and other tax agencies’ directives. The software allows firms to keep track of which expenses they are allowed to deduct and provides easily accessible proof in the event of an audit.

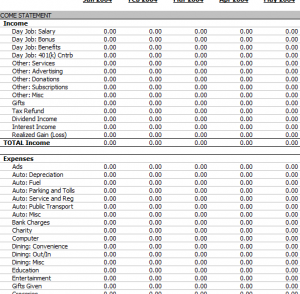

Dashboards give consolidated spending data to managers in a visual format that is easier to grasp and evaluate. Real-time data provide insight into the current situation of corporate operations. Having all of your spending data in one place can also aid finance teams in creating future spending budgets.

Custom reports delve into the specifics of who is spending, how much they are spending, and in which areas they are spending. They also provide trends, such as how long it takes to approve an expenditure report, report status, and where they are in the approval process. This aids finance teams in identifying areas for cost savings, tightening spending restrictions, and strengthening the bottom line.

Expense management software has mostly replaced paper reports, stacks of receipts, and spreadsheets in larger enterprises, but smaller businesses are more prone to cling to inefficient manual processes and methods. This can have serious ramifications: Employees who work for small organizations without expense software risk purchasing something that isn’t permitted and dissatisfaction with lengthy processes and refund delays. When identical or fake rumours slip over the cracks, they can’t notice expenditures incurred on a client’s behalf promptly, and unintended mistakes result in tax penalties, they may see an impact on their cash flow.